2017 income tax relief malaysia

24 rows The amount of tax relief year 2017 is determined according to governments graduated scale. Though experts said that this latest budget covers a wide area of the economy.

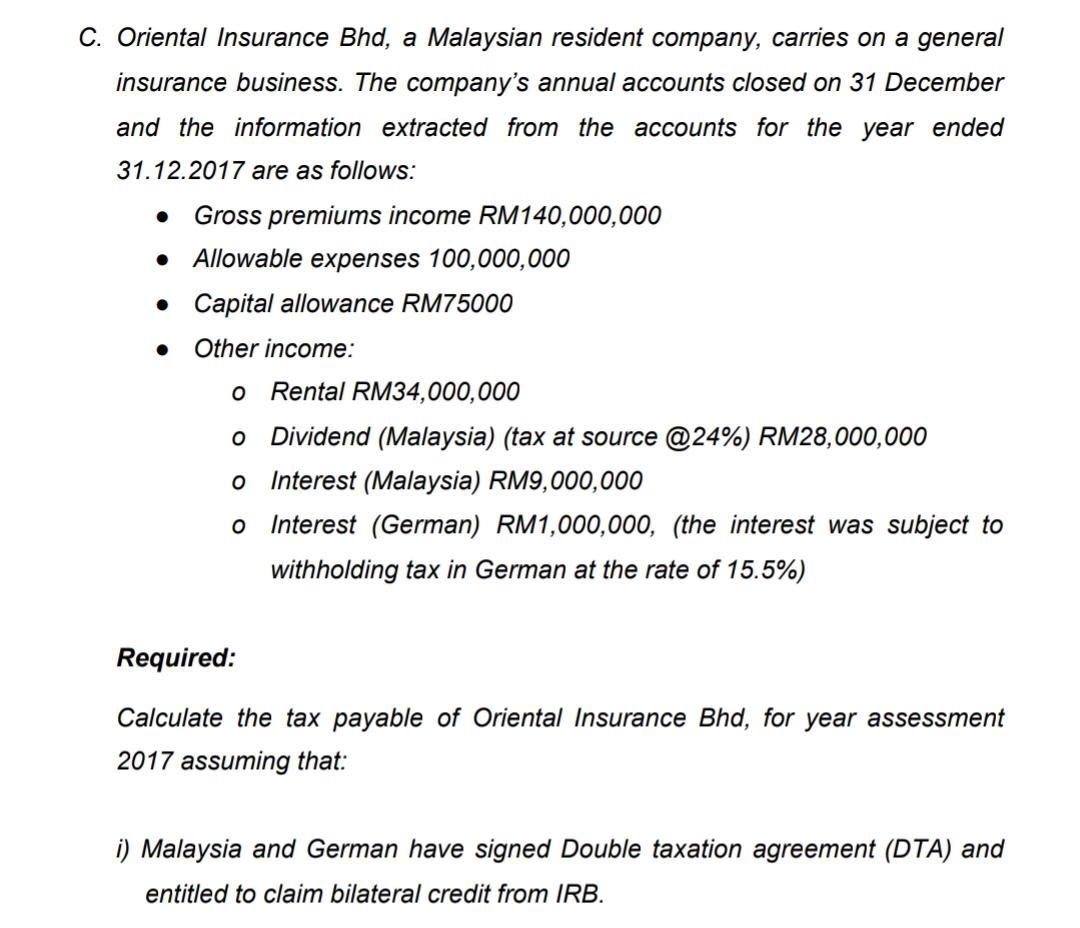

C Oriental Insurance Bhd A Malaysian Resident Chegg Com

RM5000 - RM20000.

. Calculations RM Rate TaxRM 0 - 5000. Tax service only available for our clients check out with us should you need help. Assist or advise without reasonable care others to under declare income rm2000 to rm20000 or imprisonment or both attempt to leave the country without payment of tax on conviction.

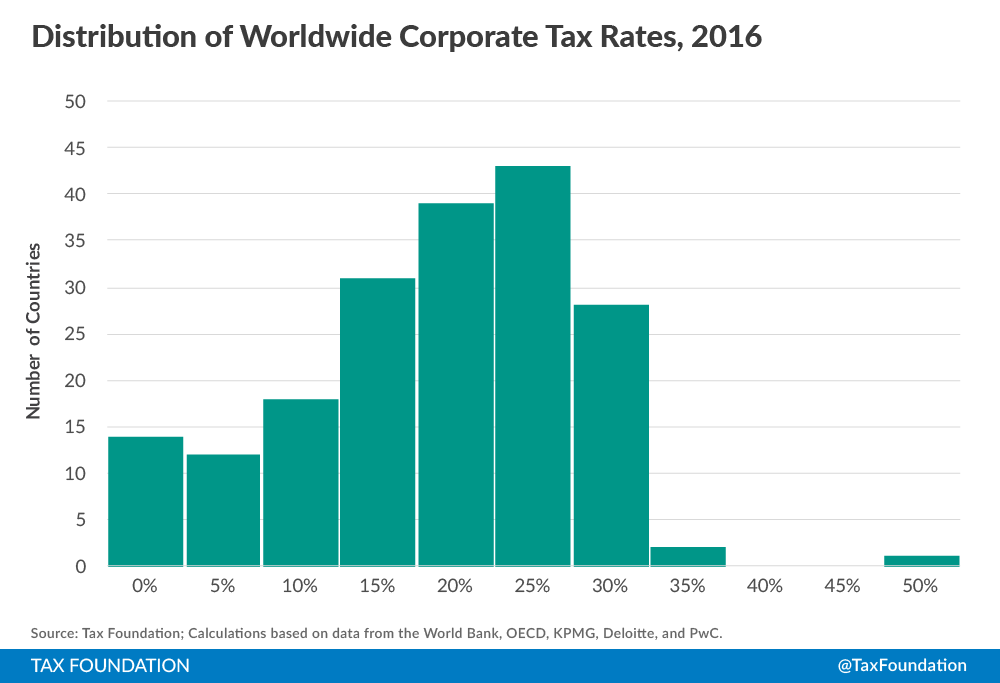

It is proposed that with effect from the year of assessment YA 2017 the corporate income tax rate for the chargeable income up to RM 500000 will be reduced by 1 from 19 to 18 to. Income range Malaysia income tax rate 2017. Up to RM5000.

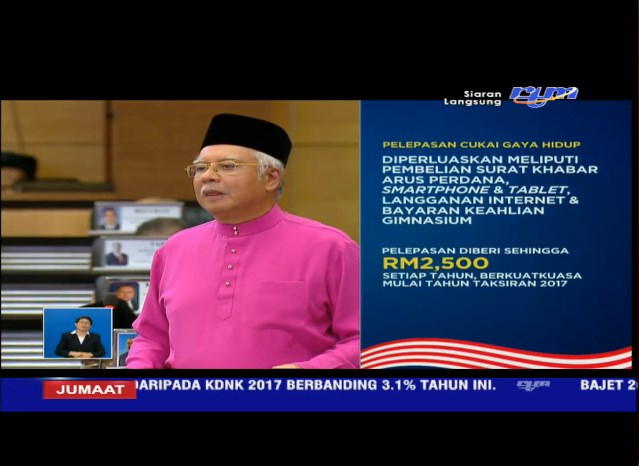

Contact us at 603-2181 2882. Malaysia Budget 2017 has successfully been tabled by the Prime Minister Datuk Seri Najib Razak. RM35000 - RM50000.

The new scheme for encouraging business growth by reducing the income tax rate by 1-4 for increases in chargeable income is a step in the right direction. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the purpose to reduced the burden of tax payers. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

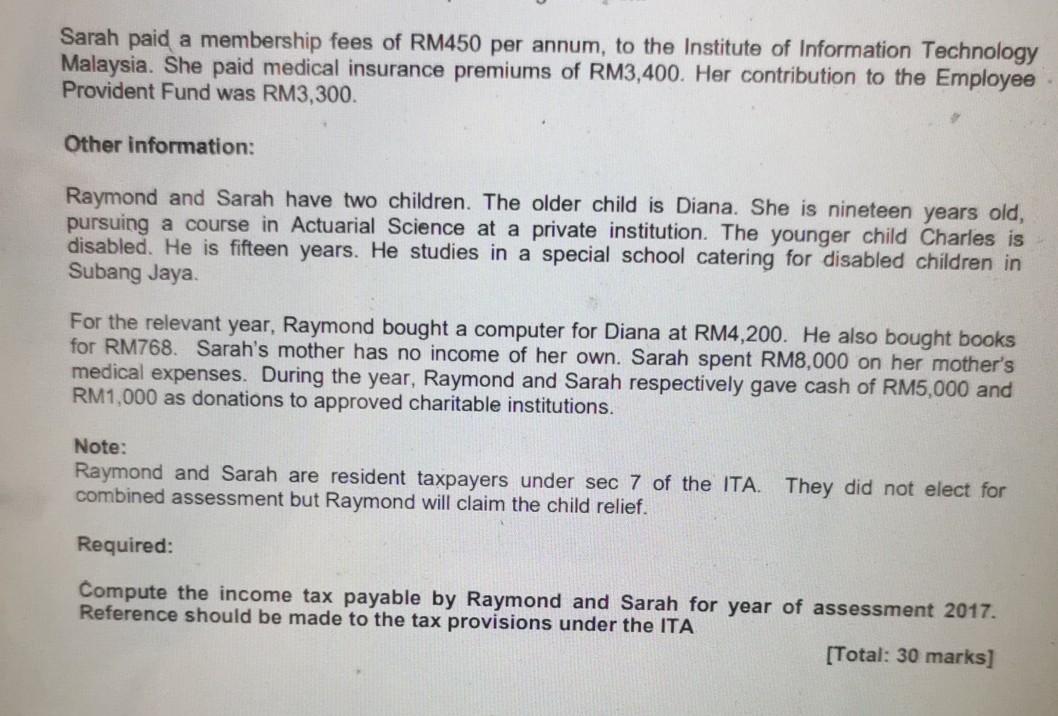

F8 F9 F10 F10 Nasional spouse not a disabled person has gross income exceeding RM4000 derived from by the Minister of Finance F12 Resident Individual Who Does. Unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years. Relief Tax Deduction Rebate.

For corporate income tax purposes the statute of limitation is 5 years whilst the statute of limitation for transfer pricing is 7 years. You can submit your tax filling personally via online thru hasilgovmy website. Lhdn income tax reliefs actually paying a lot more malaysia personal guide 2019 individual how to calculate monthly pcb malaysian.

RM20000 - RM35000. A 2532017 that are effective as from year of assessment 2015 were published in malaysias federal gazette to provide incentives to qualifying companies that are incorporated. Get Instant Recommendations Trusted Reviews.

Income Tax Monthly Deduction Table 2017 Malaysia. The reduction of the SME. 12 rows Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower.

E Filing File Your Malaysia Income Tax Online. The acquiring company should review any tax.

:max_bytes(150000):strip_icc()/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg)

Tax Cuts Definition Types Effect On Economy

Malaysia Budget 2017 What Is Lifestyle Tax Relief

Malaysian Income Tax 2017 Mypf My

Budget 2017 Sees Lifestyle Tax Relief Extended To Smartphones Tablets Internet Subscriptions Lowyat Net

Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing

Personal Tax Reliefs In Malaysia

The Purpose And History Of Income Taxes St Louis Fed

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

These Are The Personal Tax Reliefs You Can Claim In Malaysia

Corporate Tax Rates Around The World Tax Foundation

Malaysia Personal Income Tax Relief 2021

Raymond Is An Accountant With Capital Consulting Sdn Chegg Com

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

What Are The Sources Of Revenue For State Governments Tax Policy Center

Incometax Handy Guide To Malaysia S Personal Income Tax Filing In 2016 Hype Malaysia

What Is A Tax Gross Up For Payroll How To Calculate Examples

到底几时要报税 2017年 Income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

0 Response to "2017 income tax relief malaysia"

Post a Comment